► In the heart of Brussels, at a walking distance from EU institutions, lies a universe of very (very) well funded “non-profits”. Welcome to Brussels’ 5 magic words wonderland – AISBL – Association Internationale Sans But Lucratif, designed to promote transparency but perfected for opacity.

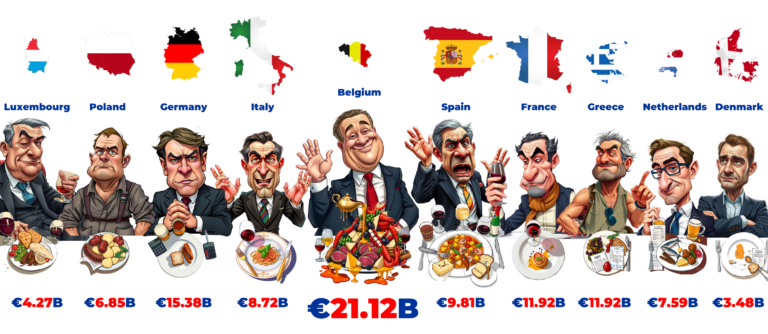

€7.87 billion in direct EU grants went to 3.101 Belgian NGOs and nonprofits between 2014 and 2023.

With €7.87 billion, we could’ve housed 150,000 families, or funded 5 million homes with solar panels, or built 3,500 km of clean transport networks. Instead? It paid for glossy annual reports filled with photos of high-level policy meetings, vague pie charts, and executive salaries that make multinational CEOs blush.

The EU Court of Auditors’ 2023 review of Brussels-based nonprofits found 70-80% of budgets allocated to “human resources”, yet audits rarely verify if these costs reflect actual staff or inflated freelance invoices (ECA Report, 2023).

The result? A taxpayer-funded model where HR budgets function like black holes — dense, complex, and nearly impossible to audit. Wrapped in mission statements and hidden behind layers of procedural paperwork, these setups fall into what auditors themselves called “beyond our scope”.

While no criminal wrongdoing is claimed here, the operational patterns reveal a systemic design flaw. The current rules allow AISBLs to leverage Belgium’s legal infrastructure for creative staffing arrangements, maintain micro-status to avoid public scrutiny, and engage in what observers describe as “project fragmentation” — a model where overlapping EU grants make timesheet accountability nearly untraceable. All of this, in a country that — notably — has no dedicated anti-fraud office for EU funding oversight.

The Belgian non-profit Elite - one example

Step inside the velvet-lined corridors of EU funding’s most well-connected players — a world where “non-profit” often describes the legal form more than the financial reality. In this ecosystem, paperwork trumps accountability, and millions in public funds are absorbed into structures labelled “management fees”.

Let’s talk about Jan — a character inspired by verifiable internal documents and statutory filings from one high-profile Brussels-based AISBL.

According to those records, Jan’s private company invoiced €21,352.87 per month in 2022 for his services — representing approximately 45% of the association’s total HR budget. Based on recent activity, that figure may have since increased beyond €25,000 per month.

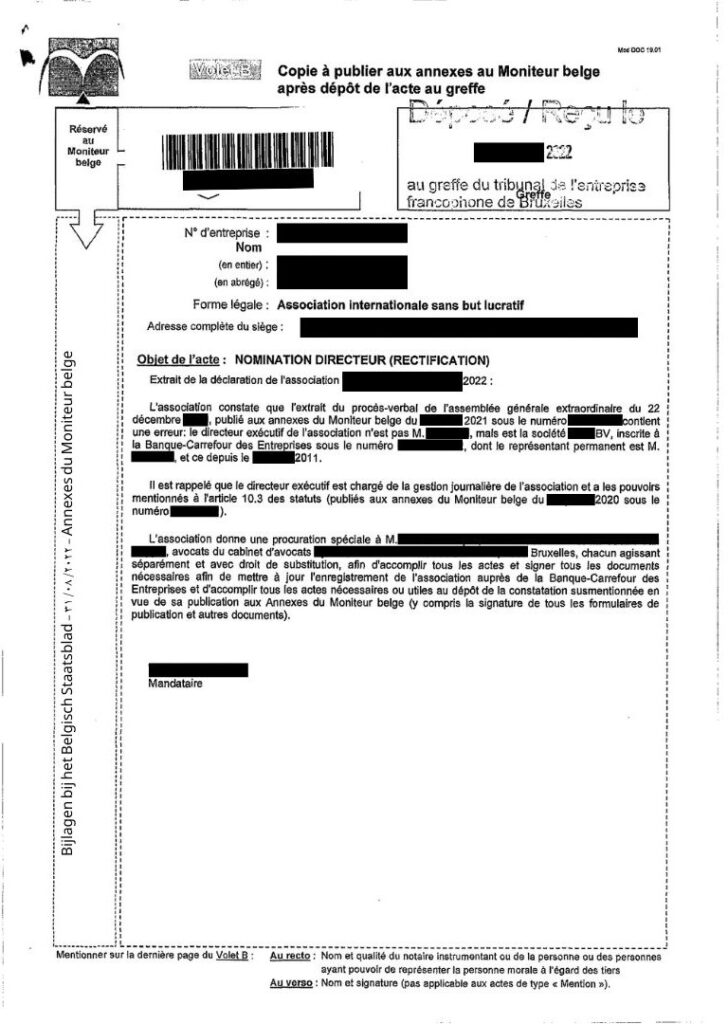

In 2022, the AISBL’s legal papers (the statutes) were quietly amended to replace Jan’s directorship with his company’s name, legally reframing him from executive director to “external service provider”. He was the executive director as a private person for over 10 years.

Internal activity reports show Jan logging even 174 project hours per month for EU-funded projects. Yes, 174 hours. Per month. While also running the organization. And yes, these hours were submitted for reimbursement under EU grants — and accepted by funding authorities.

The organization in question is not small. Its Board of Directors includes representatives from globally influential players such as Microsoft, Veolia, Suez, Xylem, Ragnsells, Coca-Cola. While their presence may reflect the association’s high strategic relevance, the concentration of institutional and corporate power around this AISBL raises important public interest questions: does such collective reputation act as a safeguard — or a shield?

Ready to see how the AISBL system works?

Let’s look at the money — and the 8 patterns that should have triggered alarms. The following isn’t fiction. It’s the operating manual — as seen, documented, and tolerated — within one of the EU’s best-funded nonprofit structures.

STEP 1: The "public face" trick

Show off 11 team members on your website while officially employing only 3. Other 5 of them? Just “external consultants” who happen to work full-time since 5-7-10+ years, have organization email addresses, attend mandatory meetings, ask for permission to go on holiday, are the management or report directly to management and have no other “contracts”. But definitely not employees!

Red flag: Belgian Social Security Law Article 328 prohibits false self-employment. The control and authority test used by Belgian courts would likely qualify these roles as actual employment.

STEP 2: The Micro-AISBL shield

Keep your formal employee count under 5. That way, you qualify as a “micro-AISBL” under Belgian law (*Article 3:47 of the Code of Companies and Associations) — which means no obligation to publish full financial accounts with the National Bank. On paper: 3 employees. In practice: 5 extra freelancers who work like employees, plus a revolving door of poorly paid interns. The result? Legal invisibility. And no one’s watching!

Red flag: Article 3:47 §4 of the Belgian Code of Companies and Associations — organizations must report their true employment situation, not workaround structures designed to avoid oversight.

STEP 3: The Annual Report smokescreen

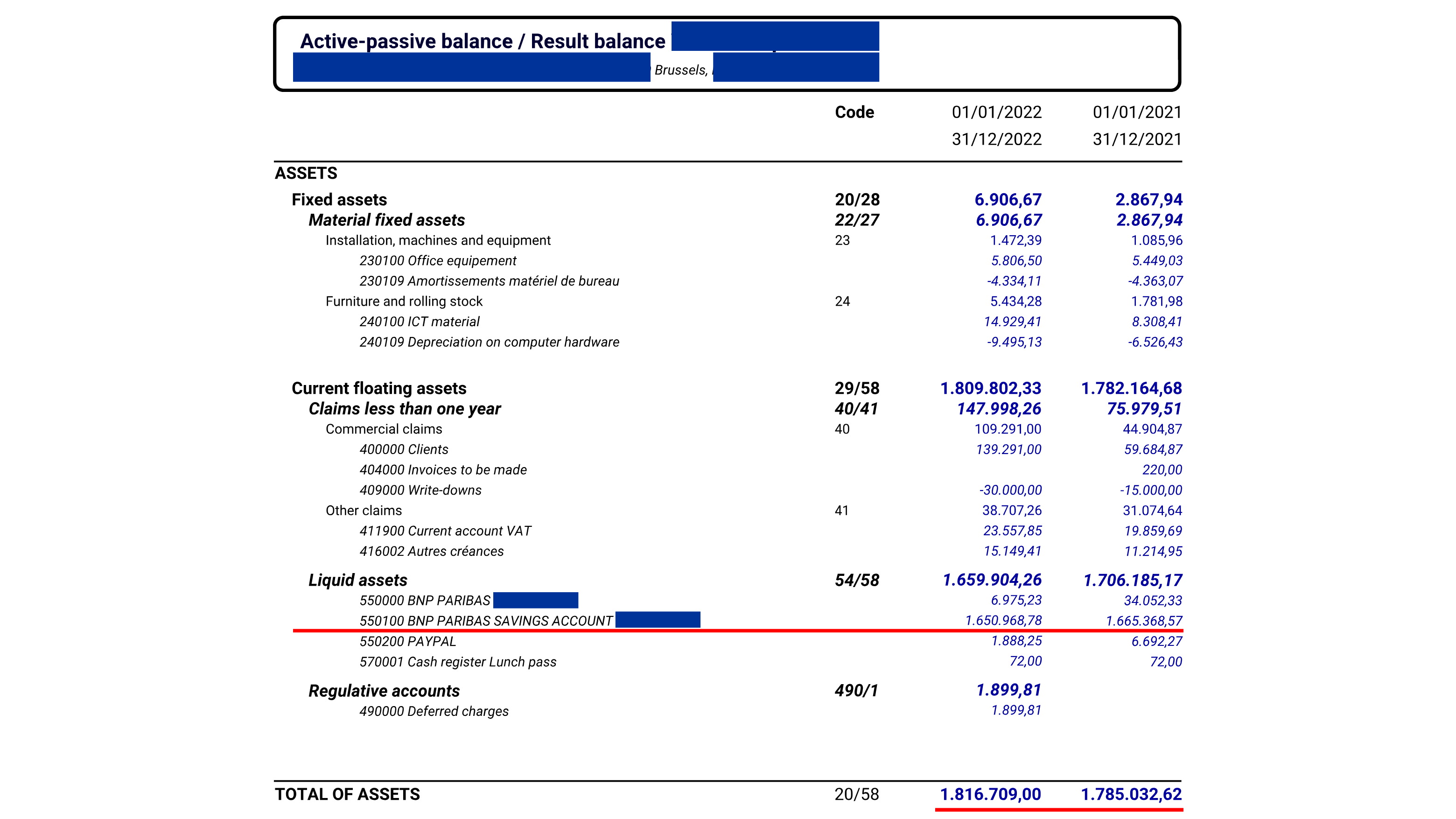

Don’t publish actual financial statements — publish an “annual report” full of inspirational quotes, blurry photos of panel discussions, and colourful pie charts labeled “EU grants” and “HR costs”. Real details? Tucked away. That €1.66 million in savings? That €829,000 in deferred project income? Just leave them out. After all, you’re a micro-AISBL, right? Belgium won’t ask questions.

Red flag: Belgian accounting law requires a “true and fair view” of financial position — vague summaries and visual fluff don’t cut it. Or do they?

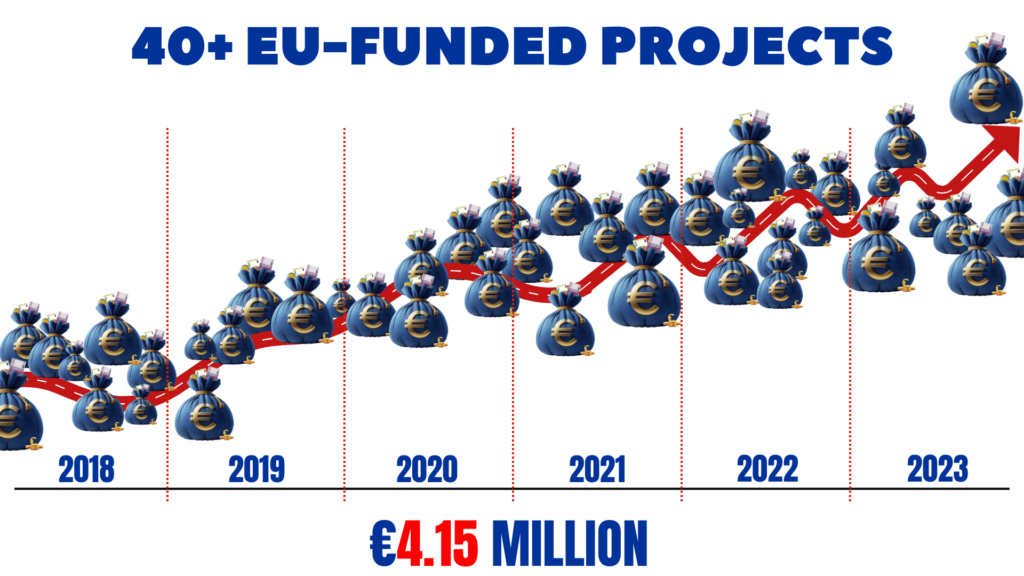

STEP 4: The Project Multiplication scheme

Instead of asking for one big grant, apply for 40 smaller EU-funded projects. Each grant officer only sees a slice, so no one tracks the whole pie. Since 2018, this strategy brought in over €5 million. With enough fragmentation, the numbers never trigger alarms — because no one compares them.

Red flag: Article 136(1)(d) of the EU Financial Regulation — prohibits grave professional misconduct, including intentional misrepresentation of project capacity.

STEP 5: The Wage Manipulation strategy

Pay your regular employees as close to the Belgian minimum wage as possible — €2,111 gross, in this case. But for yourself? Invoice yourself through your own company €21,352 per month, and call it “external consulting.” It’s not just efficient — it’s legal creativity. It’s Belgium, of course big bosses take home themselves 45% of the total human resources cost – EU is there to pay for your extravaganza. On paper, you’re not even employed.

Red flag: Belgian Tax Code and Social Security legislation prohibit income splitting and disguised employment aimed at evading employer obligations.

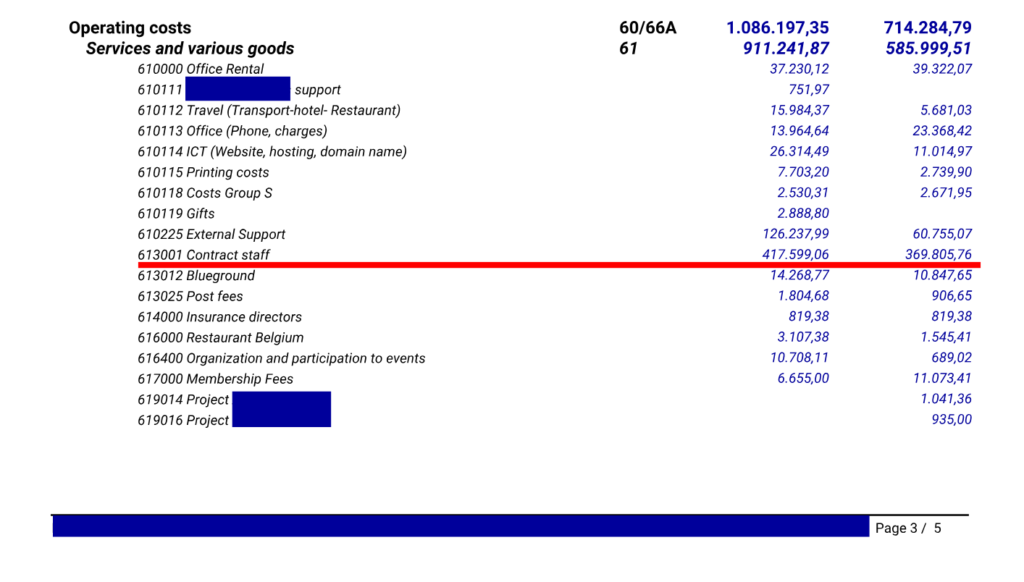

STEP 6: The accounting classification trick

Want to avoid disclosing your real size? Reclassify staff as “external services” (code 613001). In 2022, the AISBL’s books reported €417,599.06 under “contract staff” — versus €112,789.92 for actual employees. That’s a 268% gap. The board saw it. The auditor saw it. But no one asked a thing.

Red flag: Article 1:28 of the CSA — organizations must classify staff correctly for transparency and size calculation purposes.

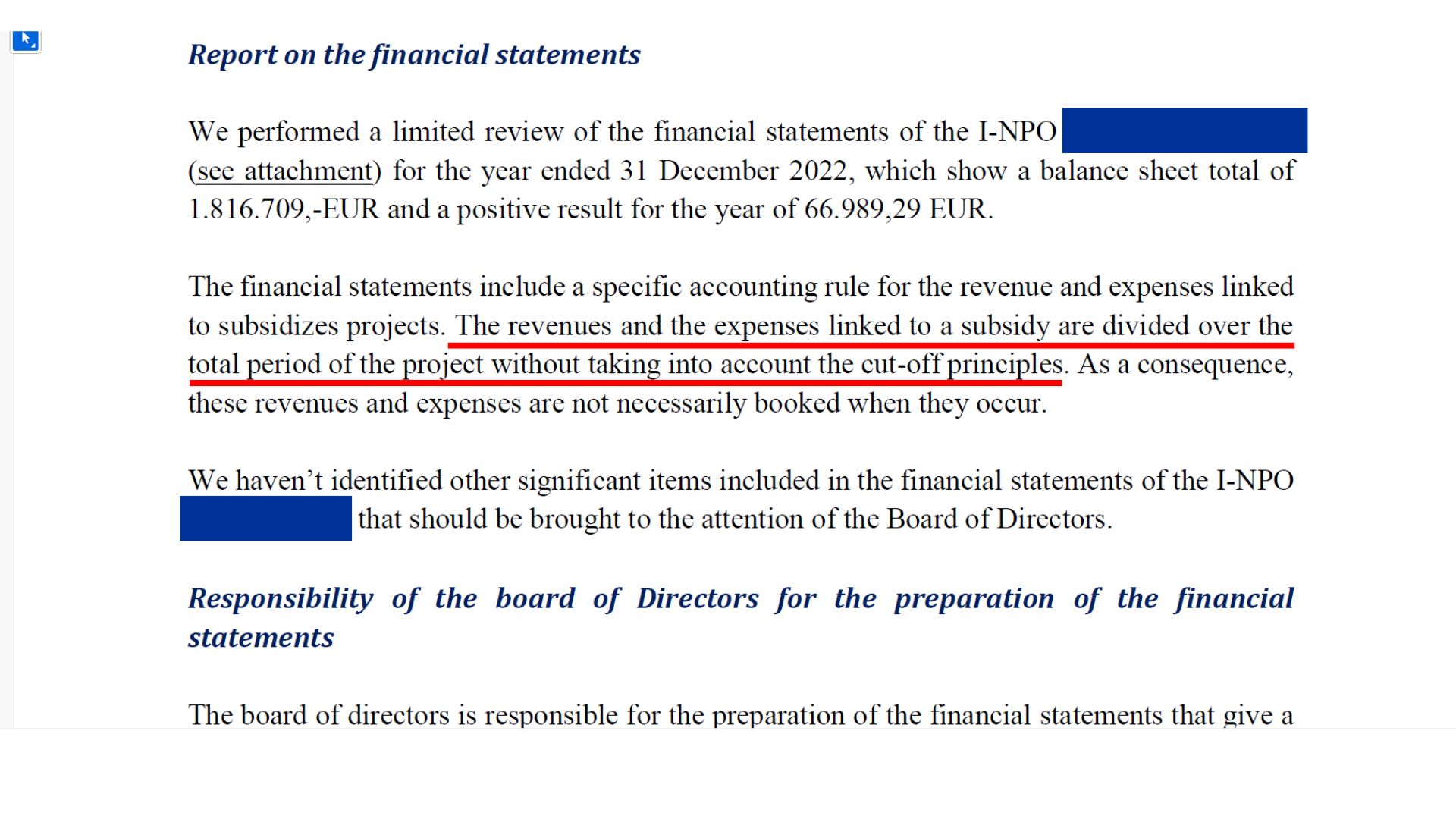

STEP 7: The Audit Report blindness

Get an auditor who knows when to keep things vague. In 2022, the official audit concluded nothing “significant” — even though the AISBL itself disclosed it didn’t respect cut-off principles, a basic rule of accounting. The board of directors approved it anyway. No questions. No flags. €1.8 million of creative bookkeeping? Business as usual.

Red flag: Article 2:56 of the Belgian Code of Companies and Associations — boards are legally liable for approving financial statements that breach accounting standards.

STEP 8: The Timesheet physics violation

Each EU project looks perfectly clean on paper — one person works 20 hours here, 30 hours there. But put them all together and it’s 170+ hours per month per person — for the same 4 to 8 people — while also managing the AISBL itself. Need more hours? Just log them. Time is flexible when no one is checking.

Red flag: Article 325 of the Treaty on the Functioning of the EU and Belgian criminal law prohibit falsification of official documents — including timesheets for EU reimbursements.